PayPal har lanserat sin mest betydande utvidgning till cryptocurrency-betalningar. Företaget tillkännagav på måndag en ny tjänst,’Pay With Crypto’, vilket gjorde att amerikanska köpmän kunde acceptera över 100 digitala valutor vid kassan. Funktionen konverterar automatiskt kundkryptobetalningar till amerikanska dollar för verksamheten.

Detta drag eliminerar volatilitetsrisken för köpmän och är omedelbart tillgänglig för alla amerikanska företag som använder PayPals plattform för online. It positions PayPal to bridge the gap between the burgeoning world of digital assets and mainstream e-commerce for its millions of users.

How PayPal’s ‘Pay With Crypto’ Bridges Fiat and Digital

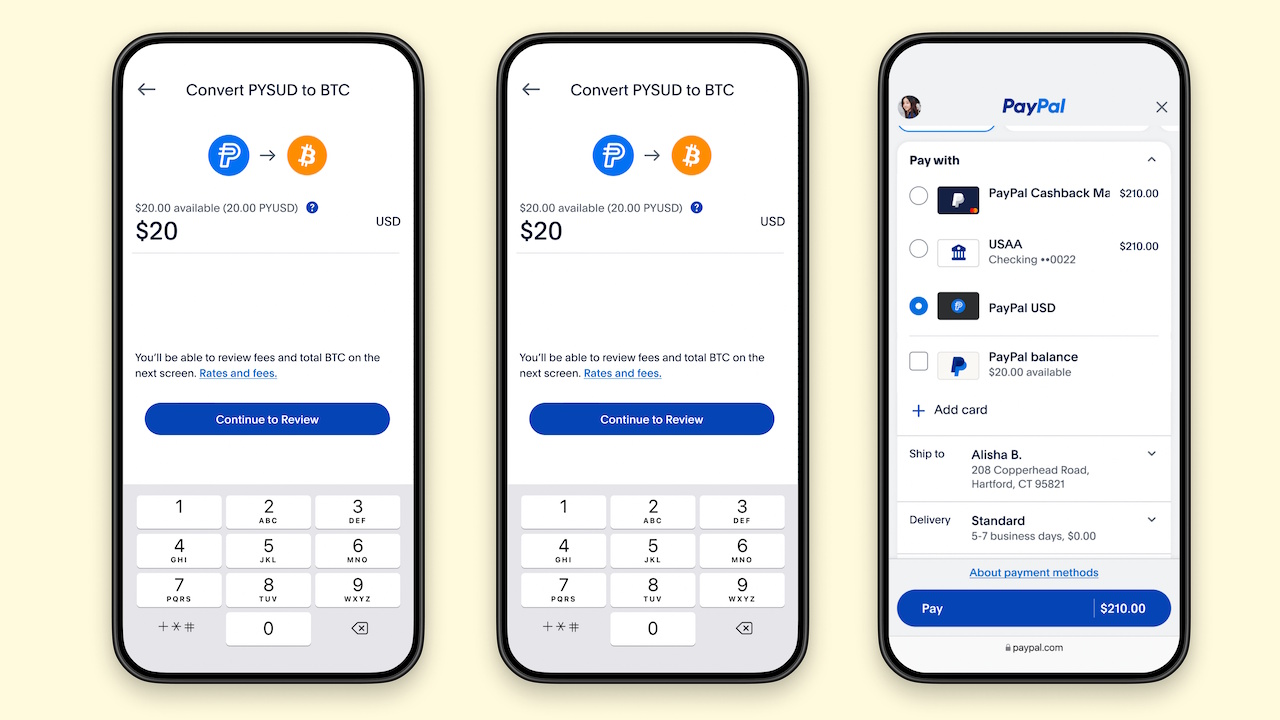

The Nya system supports från Major EXTERALT OCH EXTERAL OCH VILD VIDA VILDEN, VILKINSAM, MEL, META, METAMAS, METSAMASS, METAMASS, METAMASS, METAMASS, METAMASS, METAMASS, METAMASS, MET METAMAS, Exodus. När en kund betalar hanterar PayPal en konverteringsprocess med flera steg sömlöst i bakgrunden. It sells the cryptocurrency on an exchange, converting the proceeds into its own PYUSD stablecoin.

The final amount is then settled in U.S. dollars to the merchant’s account. För att locka köpmän erbjuder PayPal en marknadsföringsavgift på 0,99% för det första året. This will later rise to 1.5%, a rate competitive with the average 1.57% U.S. credit card processing fee in 2024.

This fee structure is designed to be highly competitive. Beyond the rate, crypto settlements can offer merchants advantages like the elimination of chargebacks, a common pain point in e-commerce, and faster access to funds compared to traditional bank settlement times.

This strategy underscores a belief in the future of on-chain transactions. Som PayPal-verkställande Frank Keller säger ,”Det finns en världsbild där du kan föreställa dig att världen rör sig på kedjan. Händer det över natten? Nej.”Genom att abstrahera komplexiteten satsar PayPal om att det ombord på miljoner företag till denna framtid utan att kräva att de blir kryptoexperter.

En beräknad resa: från Pyusd till Mass Merchant Adoption

Denna lansering är kulmen av en multi-års strategi. Tillgångar. contrast to relying on third-party stablecoins with varying levels of regulatory scrutiny.

The path was cleared significantly earlier this year. In a major win for the company, the U.S. Securities and Exchange Commission concluded its investigation into PYUSD without pursuing any enforcement action. PayPal’s quarterly filing confirmed the news, stating, “in February 2025, the SEC communicated it was closing this inquiry without enforcement action.”This removed critical uncertainty.

The closure was a landmark moment, suggesting a potential pathway for other regulated financial institutions to issue stablecoins without them being automatically classified as unregistered securities. Since then, PayPal has been actively bolstering its ecosystem, notably through an expanded partnership with Coinbase to increase PYUSD adoption.

A Changing Tide: Regulatory Headwinds Ease as Industry Adopts Crypto

PayPal’s methodical expansion stands in stark contrast to the fate of Meta’s ambitious Diem project, which was scuttled by intense global regulatory backlash. Meta’s Libra (later Diem) aimed to create a new global currency, sparking fears among central banks about losing monetary control. PayPal’s approach is fundamentally different: it uses existing crypto as a payment rail, immediately converting it to USD.

Meta CEO Mark Zuckerberg acknowledged the failure but hinted at a comeback, stating, “there’s plenty of things that [we’re] late to and have to claw our way back into the game, which I think we’re pretty good at that, too.”The current environment is far more receptive. Major financial players like Visa and Stripe are now actively building stablecoin payment solutions.

This broader adoption creates a favorable landscape. PayPal’s new service is a sign of this shift, enabling cross-border commerce in a way traditional finance often makes difficult. As CEO Alex Chriss said in a statement, “imagine a shopper in Guatemala buying a special gift from a merchant in Oklahoma City. Using PayPal’s open platform, the business can accept crypto for payments.”

Despite the optimism, the company maintains a level-headed perspective. PayPal CFO Jamie Miller recently noted, “given uncertainty in the environment and the potential for a wide range of outcomes, we are appropriately cautious,”reflecting the complex economic and regulatory waters the firm continues to navigate.

Ultimately, PayPal’s ‘Pay With Crypto’ is more than a new feature. It’s a strategic move that validates cryptocurrency as a legitimate payment technology for everyday commerce. By positioning itself as the user-friendly bridge between the old financial world and the new, PayPal is making a powerful bid to define the future of digital payments.